Rent or Buy? Know What You Can Truly Afford.

Forget the 30% rule or outdated debt-to-income ratios. Tansy helps you forecast your actual cash flow so you can make a confident, informed housing decision with a clear view of what life looks like after the mortgage payment.

More than a Mortgage Calculator

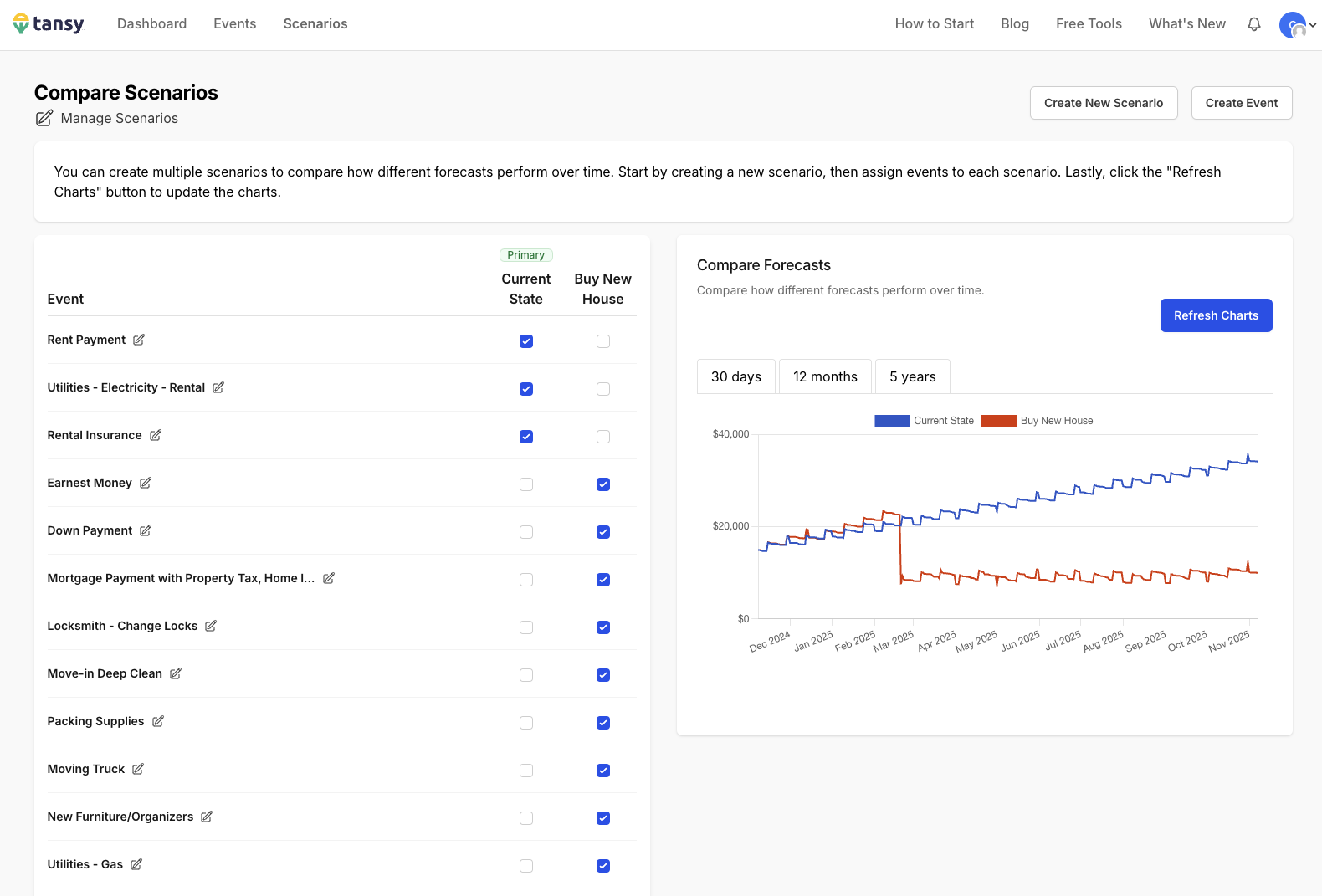

Compare Renting vs. Buying with Real-Life Cash Flow

The New York Times Rent vs. Buy calculator is helpful—but it ignores the rest of your life. Tansy shows you how buying affects your finances month to month, factoring in everything from daycare to commuting costs to lifestyle shifts. It’s not about whether you can buy a house—it’s about whether you should.

How Tansy Works

- Map Your Finances: Enter income, recurring expenses, and big upcoming costs like daycare, vacations, or car repairs—so you can plan for real life, not just the loan.

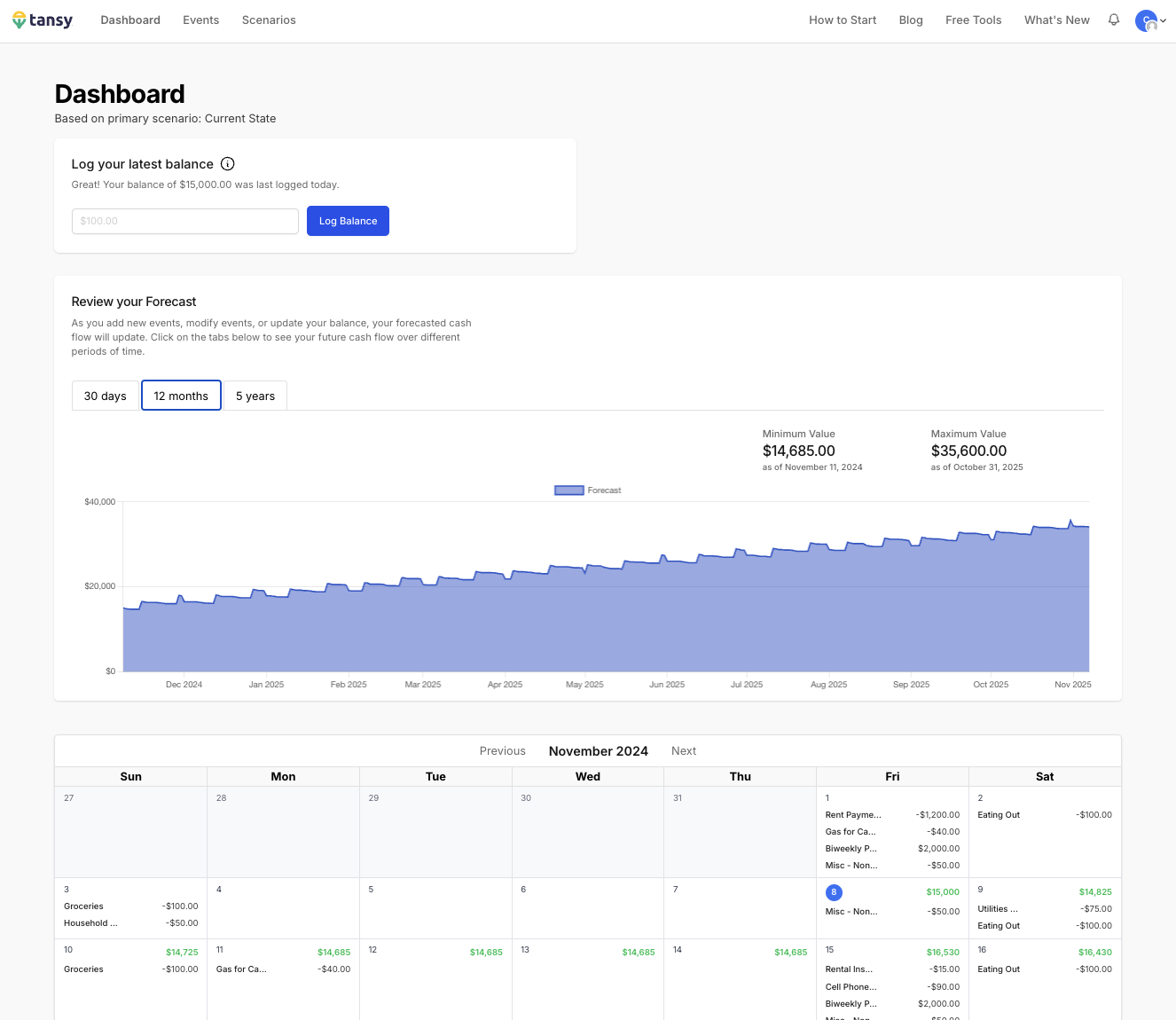

- Visualize Cash Flow: See how your money flows over time, whether renting or buying—over 30 days, 12 months, or 5 years. Avoid surprises and plan with peace of mind.

- Escape the “House Poor” Trap: Go beyond mortgage calculators. Tansy shows whether you’ll have enough for everything else life demands—today and tomorrow.

- Compare Real Scenarios: Build side-by-side forecasts: rent vs. buy, or buy now vs. wait a year. Get the numbers behind each path so you’re never guessing.

- Coming soon! Plan for Life Events: Quickly see how having a baby, switching jobs, or taking on student loans affects your financial runway.

Tansy moves beyond the rule of thumb that housing should cost no more than 30% of your income. That rule ignores real-world costs—like daycare, travel, or medical expenses—that aren’t debt, but still drain your bank account. With Tansy, you forecast cash flow, not just affordability ratios. It's a better way to decide.

Tansy: Built for Every Income and Expense

No matter your income or expense pattern, Tansy adjusts to fit your unique financial world, providing insight and flexibility for real-life scenarios.

- Customizable Frequency Settings

- Schedule any income or expense as often as needed: daily, weekly, biweekly, monthly, or yearly.

- Real-Time Calendar View

- Track upcoming income and expenses on a visual calendar, providing an easy-to-read timeline of your cash flow.

- Effortless Daily Updates

- Just update your balance. Tansy adjusts your forecast instantly so you always know where you stand.

- Comprehensive Chart View

- Get projections over 30 days, 12 months, or 5 years. Test decisions and compare outcomes with clarity.

- Collaborative Forecast Sharing

- Invite others to view your forecast—ideal for couples, advisors, or co-planners making big financial moves.

- Privacy-First: No Bank Account Needed

- Tansy doesn’t connect to your bank. Just your numbers, your way—no syncing, no risk.

Frequently asked questions

- What if I currently own a home and I'm assessing whether to sell and buy a different home?

-

Tansy can help you assess the financial impact of selling your current home and buying a new one. You can create a scenario for buying a new house and compare it to your current scenario. This will help you understand how your cash flow will change if you decide to sell your current home and buy a new one.

- If I share my account will they be able to make changes to events or log a balance?

-

Yes. When you share your account, the other person will be able to make changes to events or log a balance.

- Is Tansy still useful even if I'm not planning to buy a home?

-

Yes. Tansy is useful for anyone who wants to know how much money they will have in their bank account in the future. You can use Tansy to forecast your cash flow for any scenario, not just buying a home.

- What if I want to set up forecast two separate bank accounts?

-

You just create a new forecast within your account. You can have as many forecasts as you want, but you are charged for each forecast.

- What types of scenarios can I test out in Tansy?

-

The options are endless, but here are a few examples: - What if I get a new job with a different pay frequency? - What if I want to pay off my credit card faster? - What if I want to save for a vacation? You can test out any scenario you want to see how it affects your daily cash flow forecast. You can compare different scenarios side by side.

- Does Tansy have an iOS or Android app?

-

Not yet. In the meantime, you can create a shortcut to Tansy's website on your phone's home screen. Check out this link for instructions.

- I have questions or feedback. How can I get in touch?

-

We'd love to hear from you! You can email us at [email protected].