When considering significant financial decisions like adding a new car payment, the traditional monthly budgeting approach might fall short. This is where Tansy, an innovative budgeting tool, steps in. Tansy's dynamic cash flow forecasting can be a game-changer in such scenarios. This article demonstrates how Tansy can be used effectively to evaluate financial changes in real life, using a practical example.

Background of Existing Income and Expenses

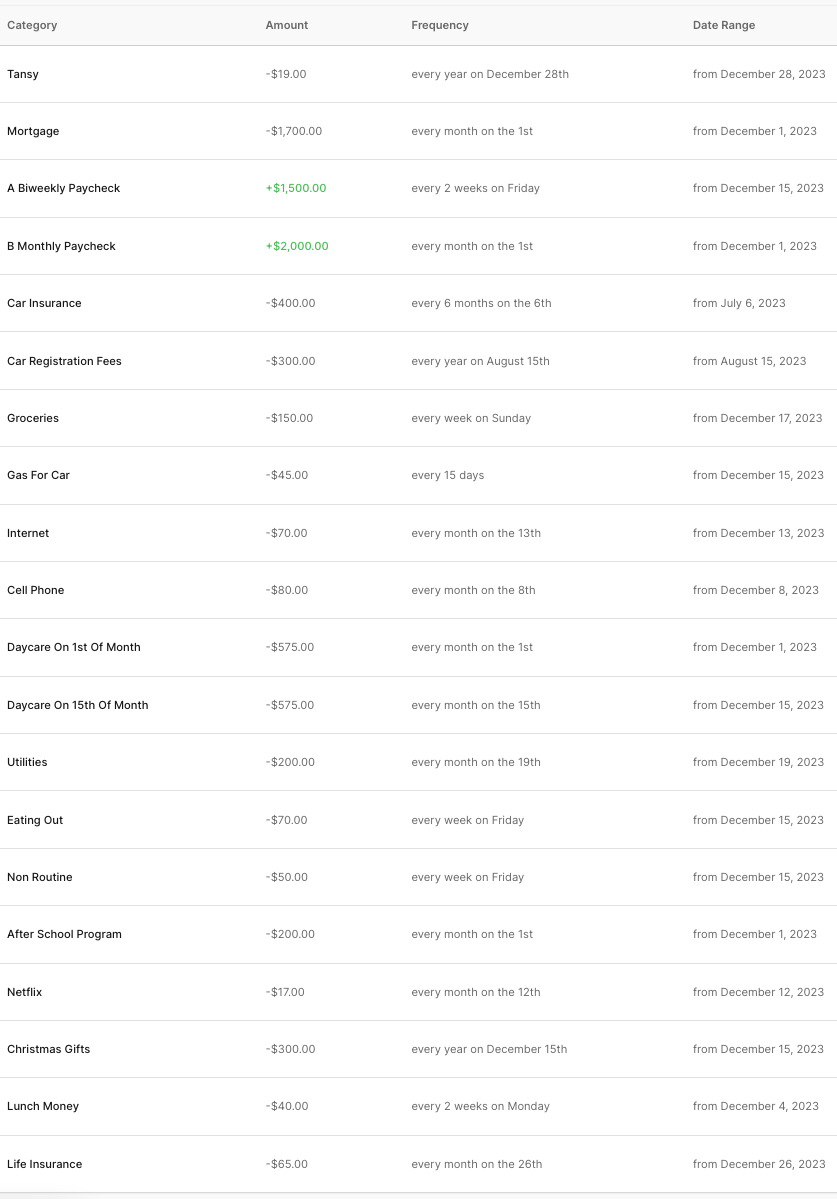

Meet Jane, part of a two-income household with typical expenses and a desire to understand if she can afford a new car payment. She is part of a two income household, carries a $1,700 mortgage/insurance/PMI payment, pays for daycare for 1 child and an after school program for a second child, and has other typical expenses (e.g. utilities, car insurance and registration, cell phone, modest eating out budget).

Here's a breakdown of all Jane's Tansy events:

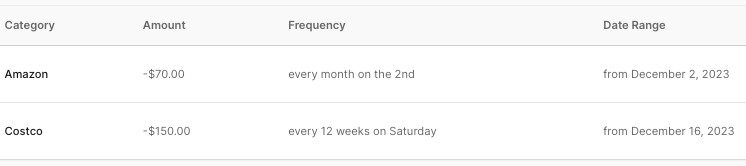

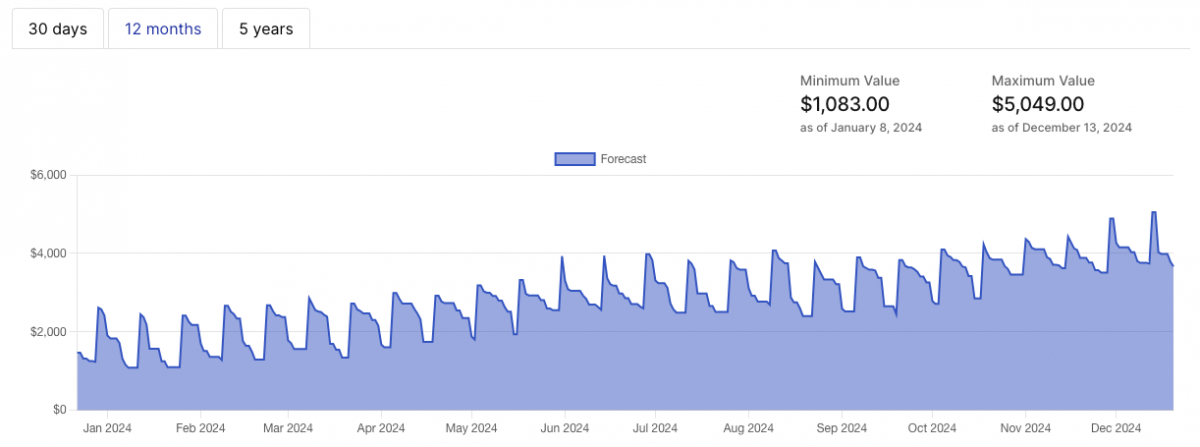

Over on Tansy's dashboard, here you can get a sense of the fluctuations in Jane's cashflow over the next 30 days, 12 months, and 5 years.

You can quickly see over the next 30 days that Jane's household is at $1,467 in their checking account as of December 22, 2023 and will dip down to as low as $1,083 on January 8, 2024. On January 12th, Jane get's her bi-weekly paycheck which helps increase the balance in their checking account.

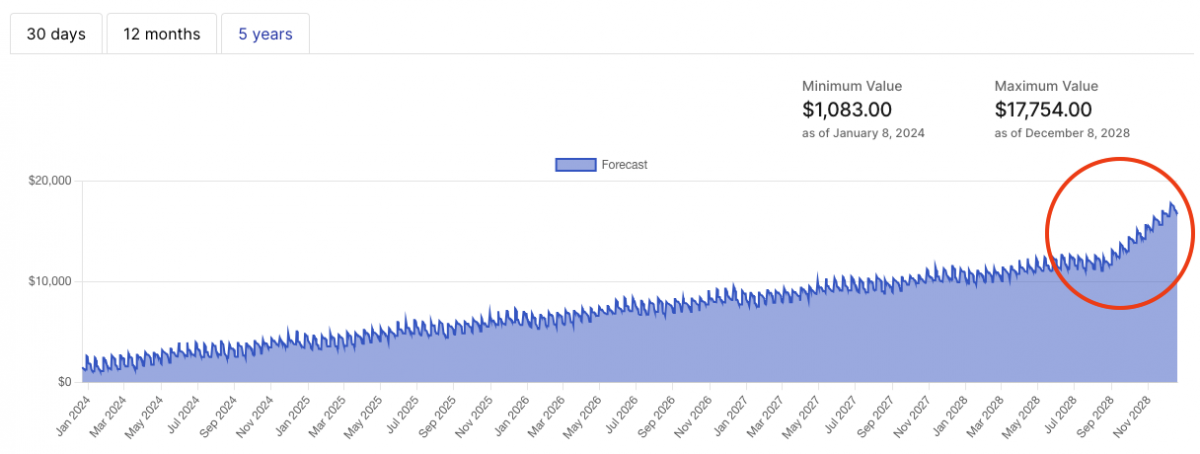

Over the next year, Jane's household steadily accumulates cash in their checking account based on their Tansy events, reaching $5,049 near the end of the 12 month time period. Jane believes that this provides some indication that they have some extra money available to take on a new car payment. And for thoroughness she checks the 5 year cash flow chart too.

The cash flow over the next 5 years reaches $17,754 near the end of 2028. This means that if Jane is looking at a 5 year car loan and prefers to keep $1,000 in their checking account at all times, it looks like they might be able to afford a $16,754 car loan without any changes in their other income or expenses or a downpayment.

Evaluating a New Car Payment

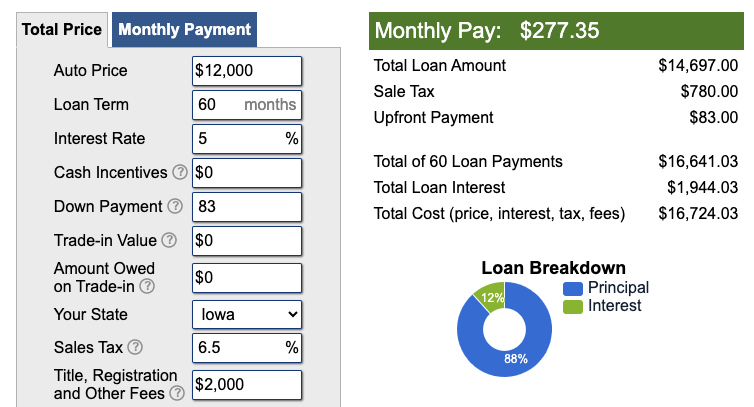

To work backwards from the $16,754 amount Jane has over their $1,000 buffer over the next 5 years, she uses an online car calculator. She assumes a $83 downpayment because that is the maximum amount they can afford currently without dipping below their $1,000 buffer.

To have a total cost of the loan (assumes all taxes, fees, etc are in the loan -- this is very conservative assumption) near $16,500, Jane and her family calculate a $277.35 car payment.

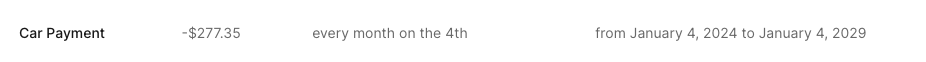

Jane creates a new event in Tansy for the $277.35 monthly car payment to start on January 4, 2024.

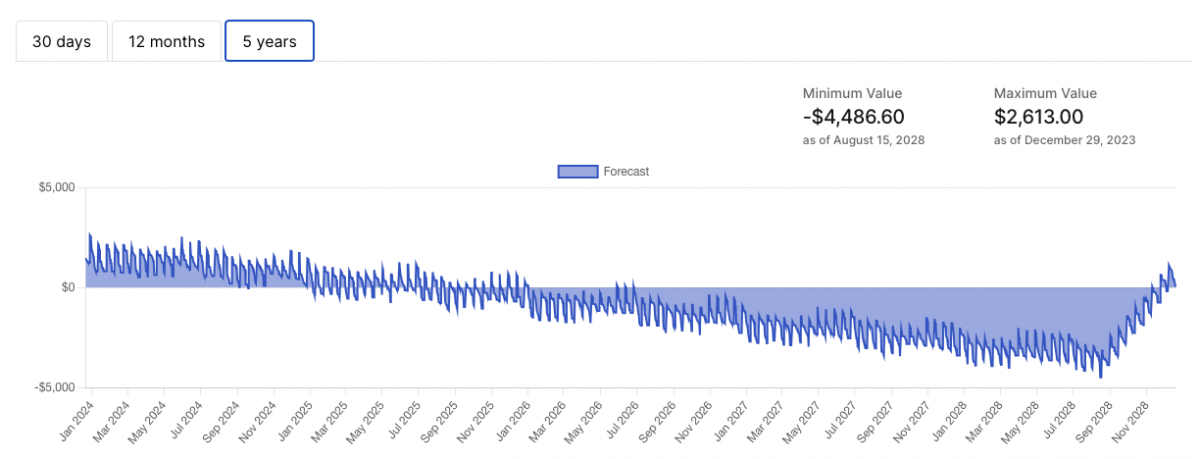

She revisits her dashboard to see that just in the next 30 days, they would dip below their $1,000 buffer threshold. Even worse, in the next 12 months they would overdraw their checking account because of how their car payment and other expenses and income line up in their cash flow. The next 5 years paints a worse picture as they would be severely negative in their checking account.

Why Can't Jane Afford the Car Payment?

Although Jane knows that they could have a $17,774 by the end of 2028 in their checking account, after adding the car payment event to Tansy, it shows that they actually can't afford it leading up to the end of 2028.

Despite appearing financially feasible in a static budget, Tansy’s dynamic forecast reveals that the variations in Jane's cash flow make the new car payment unaffordable. A significant inflection point is noted in August 2028 when her financial situation improves due to reduced childcare expenses.

What Other Options Does Jane Have?

Jane is thankful that she used Tansy to look at her cash flow forecast with the car payment before moving forward on buying a car. She would have otherwise missed that leading up to the end of 2028, they couldn't afford a $227 car payment.

She's hopeful though that there are other options she can test out in Tansy to give her confidence in buying a new car some day.

Jane experiments with:

- Delaying the car purchase.

- Reducing the car payment amount.

- Incorporating extra income in their paychecks as she wants to now pursue a promotion to increase their income.

- Reducing other non-essential expenses (e.g. Netflix, excess at Costco, etc.)

This analysis helps Jane chart a clear path towards her goal, aligning her financial decisions with her cash flow realities.

Tansy - Your Partner in Financial Decision Making

Jane’s story illustrates the power of Tansy in making informed financial decisions. Unlike traditional monthly budgeting tools, Tansy provides a dynamic and comprehensive view of your financial future, helping you understand the impact of your decisions in real-time.

If you’re considering a major financial decision like buying a car, moving to a new house, or changing jobs, let Tansy guide you. Its insightful forecasts can prevent financial missteps and pave the way for a more secure financial future.

Start your Tansy free trial today

No credit card required upfront. Start making better financial decisions now.

Free Trial